25+ Take Home Pay Calculator Dc

Income Tax Calculator 2021 If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. Payroll calculator that will do all the work for you.

Solar Panel Battery Storage Calculator Great Home

Social Security and Medicare.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in District of Columbia. Thats why we created a simple Washington DC. Estimate your 2021 income tax return with our free calculator tool.

Currently there are two income tax slabs from which a salaried individual has to choose one every year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. On top of the federal income tax you need to pay the state-level income tax ranges from 4 to 1075.

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Washington DC Salary Paycheck Calculator Change state Calculate your Washington DC net pay or take home pay by entering your per-period or annual salary along with the pertinent. Salary Paycheck Calculator Washington Paycheck Calculator Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

The old income tax. How much do you make after taxes in Washington DC. Taxpayers can choose either itemized deductions.

Washington DC Paycheck Calculator Estimate how much your take home pay is after income tax so you can have a better idea of what to possibly expect when planning your budget 8. Ad Use our free income tax calculator to find out what you might be getting this tax season. Your average tax rate is 1198 and your.

This Washington DC hourly. Well do the math for youall you. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Just input your employees W-4 and wage information and our calculator will. The income tax rates for these slabs are different. For example if an employee earns 1500 per week the individuals.

Some calculators may use taxable income when calculating the average.

Pdf Long Term Evaluation Of The Rise In Legal Age Of Sale Of Cigarettes From 16 To 18 In England A Trend Analysis

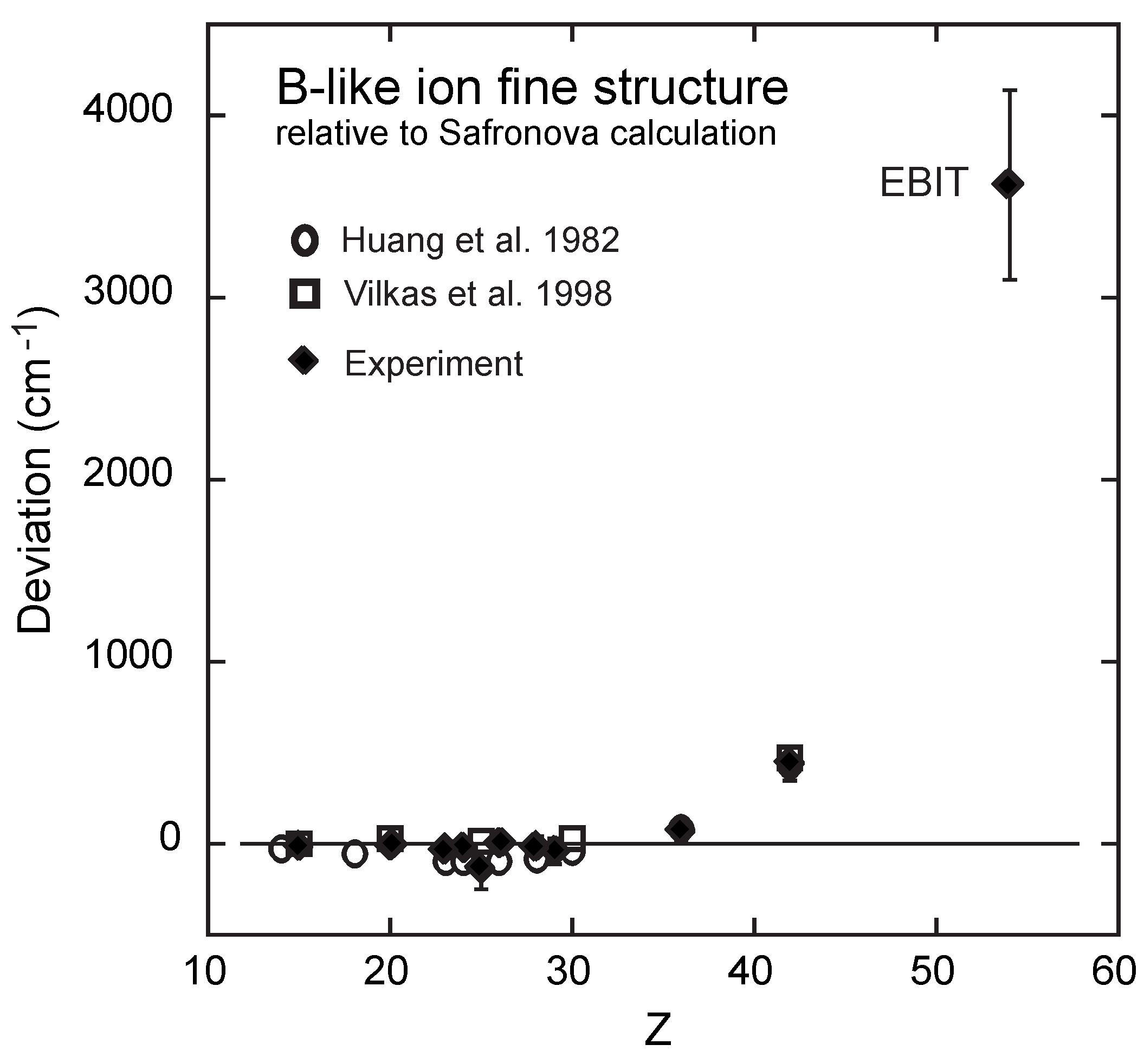

Atoms Free Full Text Critical Assessment Of Theoretical Calculations Of Atomic Structure And Transition Probabilities An Experimenter S View

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

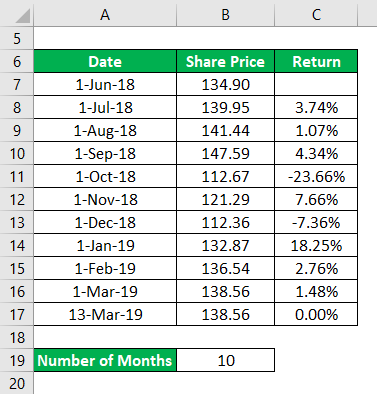

Population Mean Formula Calculator Excel Template

Fluke 120b Series Handheld Digital Oscilloscope Fluke

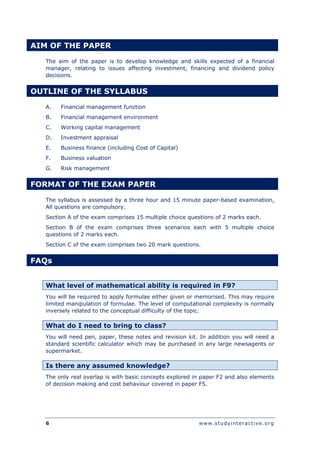

Financial Management Class Notes 1 Pdf

Gtc 2012 Program Guide Gpu Technology Conference

Sobel Test Quick Tutorial Calculation Tool

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Affordability Drives Value Insights From A Seasoned Appraiser Mckissock Learning

25 Products To Stop Buying At The Store Oak Hill Homestead

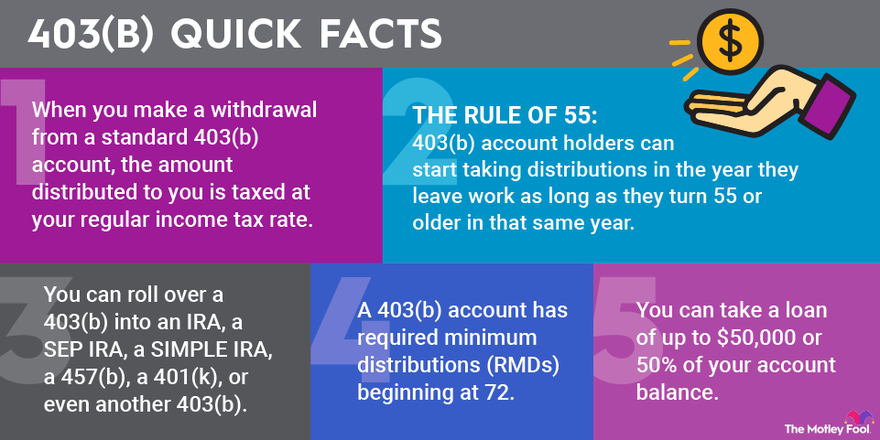

403 B Withdrawal Rules For 2023 The Motley Fool

Using An Exposome Wide Approach To Explore The Impact Of Urban Environments On Blood Pressure Among Adults In Beijing Tianjin Hebei And Surrounding Areas Of China Environmental Science Technology

The Cost Approach An Underutilized Approach To Value Mckissock Learning

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

1900 Lamont Apartments 1900 Lamont Street Nw Washington Dc Rentcafe

Sobel Test Quick Tutorial Calculation Tool